Here’s What It’s Like to Use TurboTax’s Mobile App to File Taxes on Your Own (2026) Leave a comment

I’ve used TurboTax to file my taxes for a number of years. It is the preferred DIY tax service, and in addition typically the most cost effective and arguably most easy. TurboTax has the filer in thoughts by using an easy-to-use interface, providing accessible knowledgeable assist, with totally different choices for doc auto-upload; useful ideas and data concerning tax necessities; and clear, low-cost choices for each kind of filer.

The service makes it tremendous simple for returning customers by storing earlier years’ info, permitting simple auto-upload, and remembering decisions and beforehand used kinds from years previous. Doing my taxes as a returning consumer with TurboTax takes a fraction of the time of different tax companies I’ve examined. (Want a leaping off level? I’ve received a information on the way to file your taxes on-line for further assist.)

Sure, You Can Truly File for Free

If you have not tried TurboTax, that is the most effective time to see if it is the appropriate match for you (and have the ability to file totally free). You’ll be able to file each state and federal taxes for $0 proper now. There are only some necessities for this superior free submitting deal. It’s essential to not have filed with TurboTax earlier than (and are switching from one other supplier), and you could file within the TurboTax cellular app by February 28. You may have to each begin and file throughout the cellular app; that is solely eligible on DIY (self-guided) tax companies and excludes knowledgeable help merchandise. Which means it applies to Easy Kind 1040 returns solely (which means no schedules, aside from EITC, CTC, scholar mortgage curiosity, and Schedule 1-A kinds are eligible).

One of many downsides to TurboTax is that whereas it is (for my part) the easiest-to-use interface with seamless auto-upload options, it may be a bit costlier than related opponents. I’ve used FreeTaxUSA previously, when my revenue was decrease and my taxes had been easier. The service may be very related in design to TurboTax, and whereas it’s nonetheless a low-cost possibility, it is not fully 100% free, because it cost $16 for submitting a state return. Plus, after I examined the service final 12 months, FreeTaxUSA gave me the best quantity of taxes owed from all companies I examined.

TurboTax filed greater than twice the variety of free returns as FreeTaxUSA final 12 months (primarily based on the full variety of federal and state returns filed in Tax 12 months 2024). And this tax season, greater than 100 million individuals within the US are eligible totally free submitting with TurboTax. If you happen to file your personal federal and state returns utilizing DIY TurboTax merchandise, submitting can be free should you use the cellular app till February 28.

Submitting in Your Arms

Submitting taxes may be complicated and probably costly. Whereas I urge anybody who hasn’t filed with TurboTax to benefit from the free federal and state submitting deal by means of the cellular app, there are a number of choices in case you have filed with the service earlier than or have extra difficult returns which will require further help.

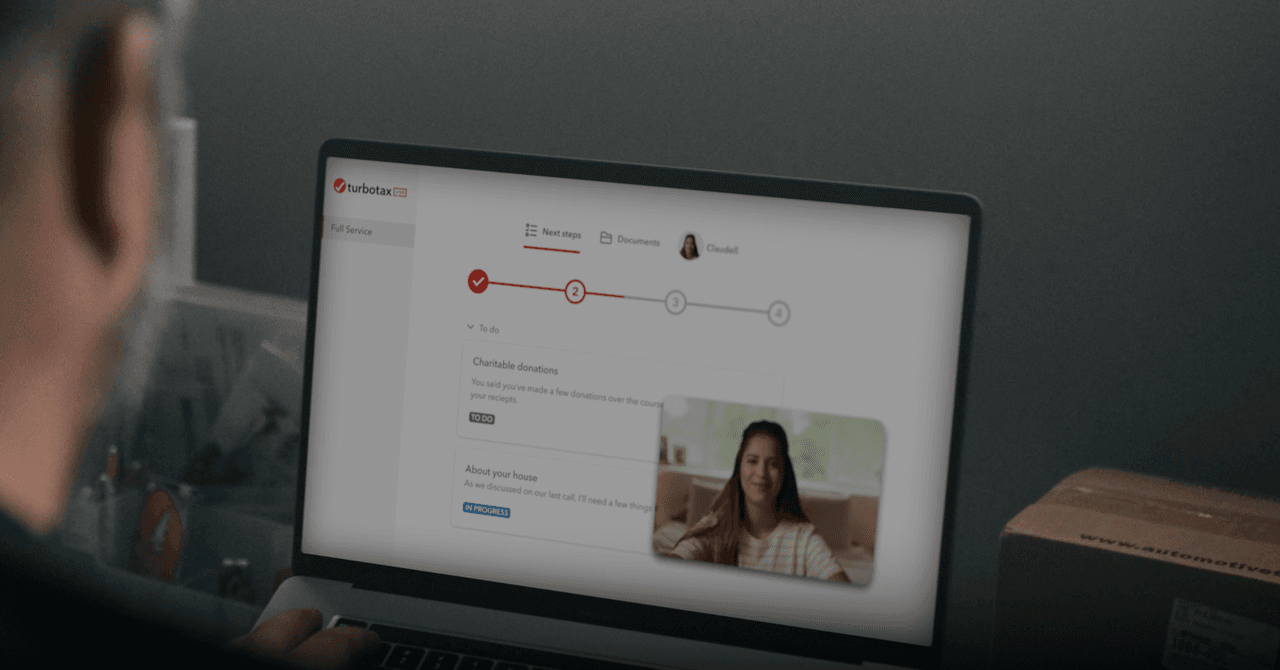

There are three choices for filers: DIY, the place you file your self with step-by-step directions (the beforehand talked about service eligible for the free submitting deal); Knowledgeable Help, the place you get assist from tax consultants all through the method and have the knowledgeable evaluate it earlier than submitting; or you can too get your taxes performed fully by a neighborhood tax knowledgeable with Knowledgeable Full Service. Costs differ primarily based on the chosen tier and once you file (the sooner, the cheaper, particularly should you’re capable of file earlier than March).

The submitting course of begins out with a useful questionnaire in order that this system is aware of which sections are relevant to you, like dependents, property, and training, so that you’re not slogging by means of issues that aren’t related. At first, TurboTax additionally estimated the time it’d take to complete and requested how I filed final 12 months—no different service I beforehand examined did both, which was useful in estimating how lengthy the method would take.